The Federal Tax Authority, FTA, has reiterated its full commitment to supporting taxpayers and enabling them to fulfil their tax obligations during these exceptional times, as authorities ramp up their precautionary efforts in the light of the new challenge the world is currently experiencing.

With that in mind, the FTA issued a decision to extend the Tax Period, which began on 1st March, 2020, for businesses registered for Excise Tax for one month, said an FTA press statement issued on Tuesday.

The period now covers the months of March and April 2020, and ends on30th April, 2020, allowing the registered businesses sufficient time to fulfil their tax obligations before the deadline.

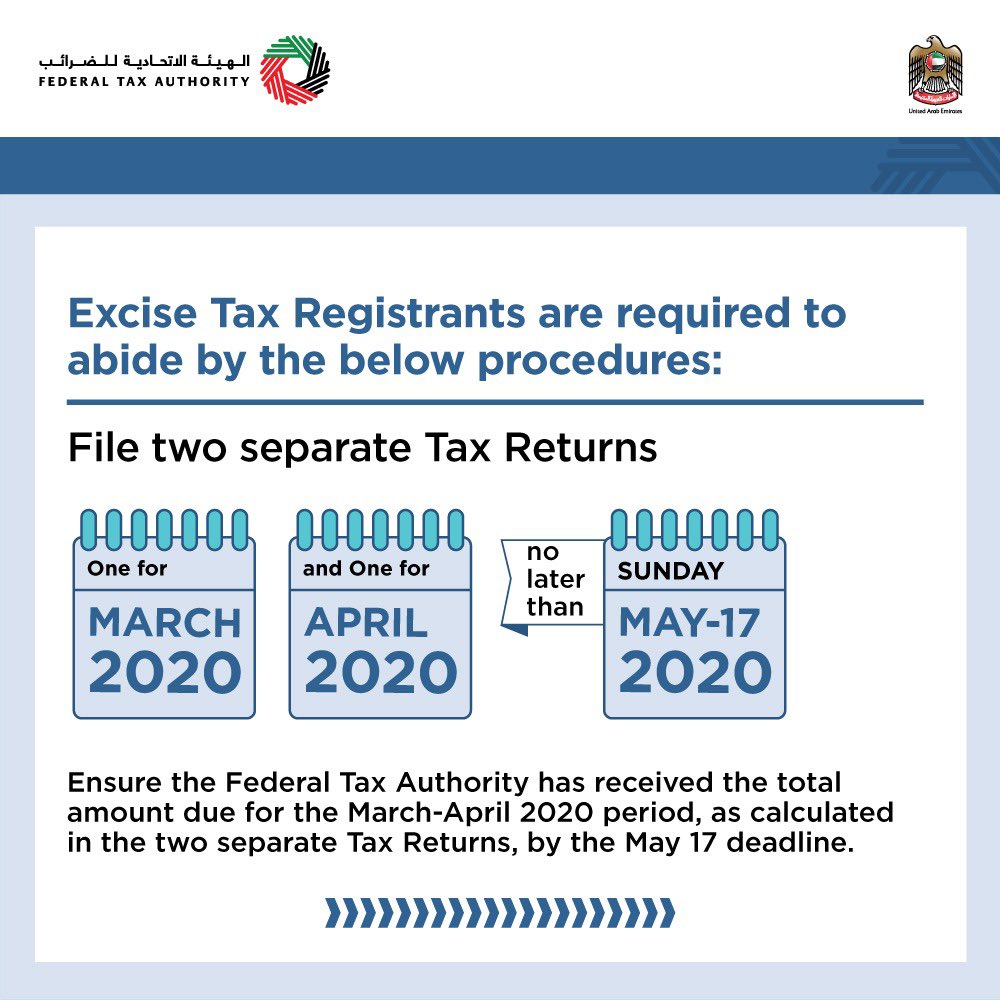

The Excise Tax registrants are required to file two separate tax returns, one for March and one for April 2020, and settle the total amount due for the two months no later than Sunday, 17th May, 2020, the FTA noted.

The deadline takes into consideration the date set by the authorities to impose the 24-hour restrictions on movement for individuals and vehicles, implemented in certain areas of the UAE, the FTA explained.

The FTA appreciates that current conditions may prevent taxable persons from fulfilling these obligations within the legal timeframes,the statement continued.

The taxable persons registered for Excise Tax – constituting 1,100 registrants – are required to submit several declarations detailing their production, import, or release of Excise Goods from Designated Zones.

The FTA asserted that it would continue providing all of its services remotely, facilitating registration procedures, as well as the filing of periodic tax returns and payment of due taxes.

The advanced electronic system promotes and facilitates self-compliance, as it allows taxable persons or their representatives to complete all transactions quickly, easily, and with no need for personal contact or paper documents.

The FTA reiterated its commitment to maintaining contact with all stakeholders in the tax system, answering their enquiries, and providing them with the information they need on systems, legislation, and executive procedures. The registrants can get in touch through the call centre or by email, said the statement.

UAE BARQ برق الإمارات – نبضك

UAE BARQ برق الإمارات – نبضك